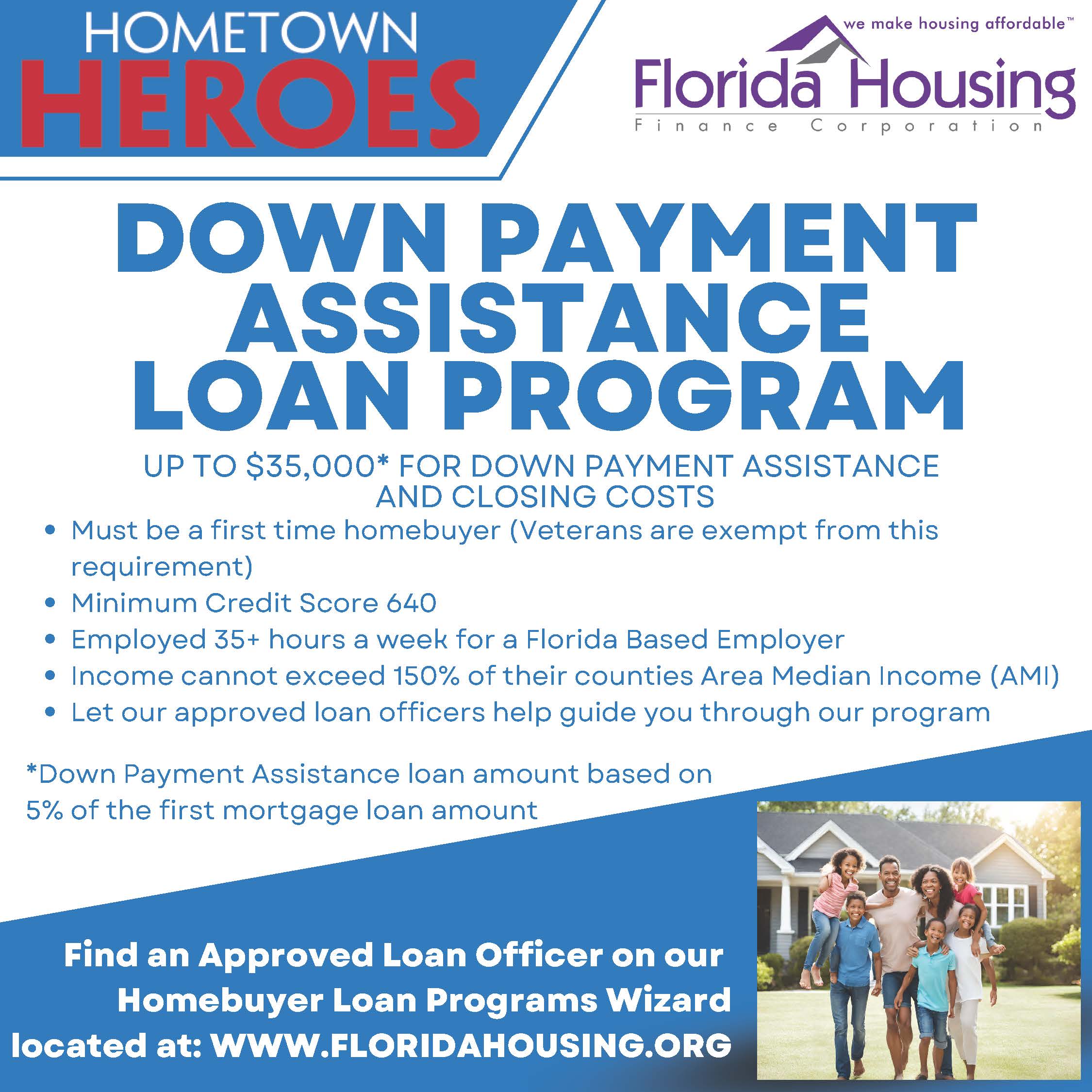

The Florida Hometown Heroes Housing Program makes homeownership affordable for eligible community workforce.

This program provides down payment and closing cost assistance to first-time, income-qualified homebuyers so they can purchase a primary residence in the community in which they work and serve. The Florida Hometown Heroes Loan Program also offers a lower first mortgage interest rate and additional special benefits to those who have served and continue to serve their country.

Program Details:

- Eligible full-time workforce, employed by a Florida-based employer can receive lower than market interest rates on an FHA, VA, RD, Fannie Mae or Freddie Mac first mortgage, reduced upfront fees, no origination points or discount points and down payment and closing cost assistance.

- Borrowers can receive up to 5% of the first mortgage loan amount (maximum of $35,000) in down payment and closing cost assistance.

- Down payment and closing cost assistance is available in the form of a 0%, non-amortizing, 30-year deferred second mortgage. This second mortgage becomes due and payable, in full, upon sale of the property, refinancing of the first mortgage, transfer of deed or if the homeowner no longer occupies the property as his/her primary residence. The Florida Hometown Heroes loan is not forgivable.

Florida Housing Finance Corporation

FL Hometown Heroes Loan Program

Eligible Borrowers:

- Borrower(s) must be employed full-time by a Florida-based employer and work 35 or more hours per week.

- The property the borrower(s) is purchasing will be their primary residence and they will be a Florida resident

- The borrower(s) are first-time homebuyers which means, a borrower(s) must have had no present ownership Interest in a principal residence at any time during the three-year period prior to the date on which the Mortgage Loan is executed.

- This requirement does not apply to active duty service members of a branch of the armed forces or the Florida National Guard, as defined in s. 250.01, F.S., or a veteran

- Borrower(s) will certify that they have not been convicted of a sex offense against a minor, terms are defined in 34 U.S.C. § 20911.

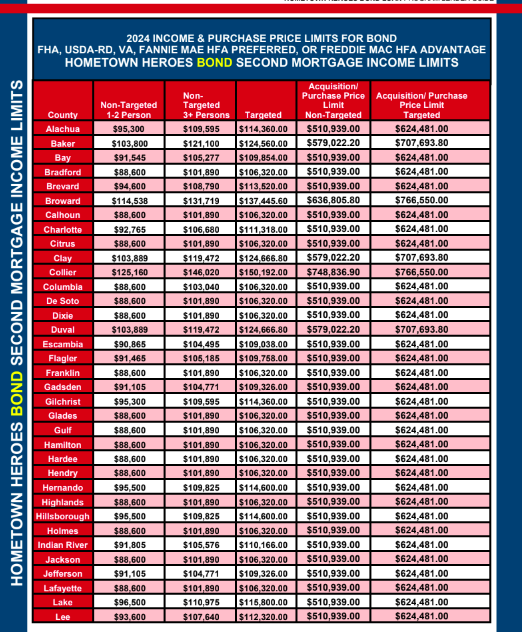

- Income Limit Requirements – Borrower(s) must not exceed the maximum Income Limit requirements, household size, for the county in which the property is being purchased. Please Note: Lenders must adhere to USDA-RD’s loan limits.

- Maximum Loan Limits – Borrower(s) must not exceed the Maximum Loan Limit requirements for the county in which the property is being purchased.

- Documentation Needed to Confirm Employment of 35 Hours a Week or More

- A written or verbal VOE indicating employment of 35 hours or more a week must be provided for all borrower(s).

- Self-Employed borrower(s) may provide a copy of work schedule provided by a third-party indicating 35 hours a week or more or a copy of paystub indicating 35 hours a week or more or copy of contract indicating 35 hours a week or more.

- Borrowers who own their own business must also be registered with the FL Department of Revenue at https://dos.myflorida.com/sunbiz/search/

- Borrowers who receive a 1099 as a contracted employee must provide a copy of their most current 1099.

- Certification Form Borrower(s) must execute the Certification Form indicating employment status of 35 hours a week or more.

- Please note that FL Housing’s down payment assistance program cannot be combined with another FL Housing down payment assistance program. (Down payment assistance from another Agency, like SHIP, may be used if the agency providing the assistance takes 3rd lien position.)

P.S. Share this with anyone you know who might be interested in buying a home in Bay County! THESE FUNDS WILL NOT LAST LONG!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link