Why Expired and Canceled Listings Are Surging

If you’ve been keeping an eye on the market and wondering why more homes are suddenly disappearing from your favorite home search app, you’re not alone. Across the country, real estate delistings—homes pulled off the market due to expiring or canceled listings—have skyrocketed nearly 50% in the past year.

📉 According to Realtor.com’s June 2025 Housing Trends Report, delistings jumped 47% in May compared to the same time last year, and year-to-date delistings are up 35% overall. That’s a massive shift—and it’s being driven by one thing:

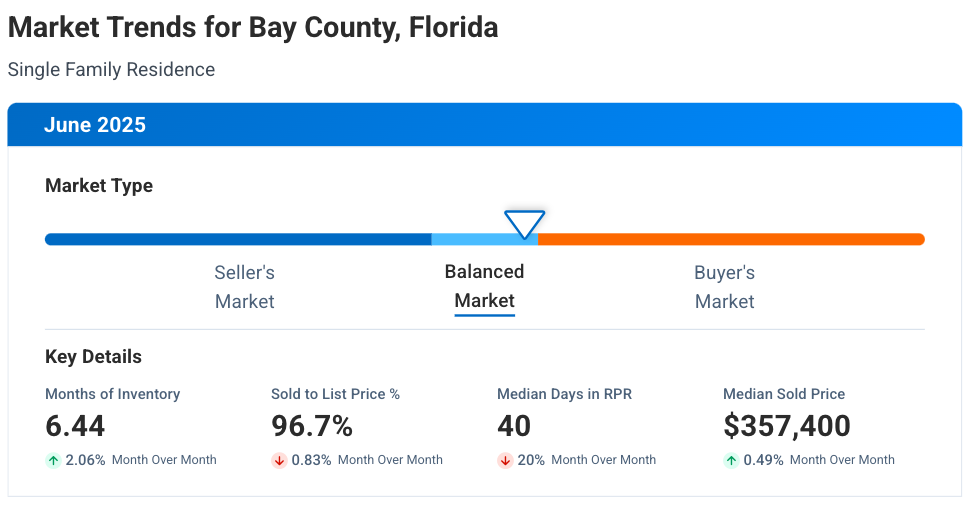

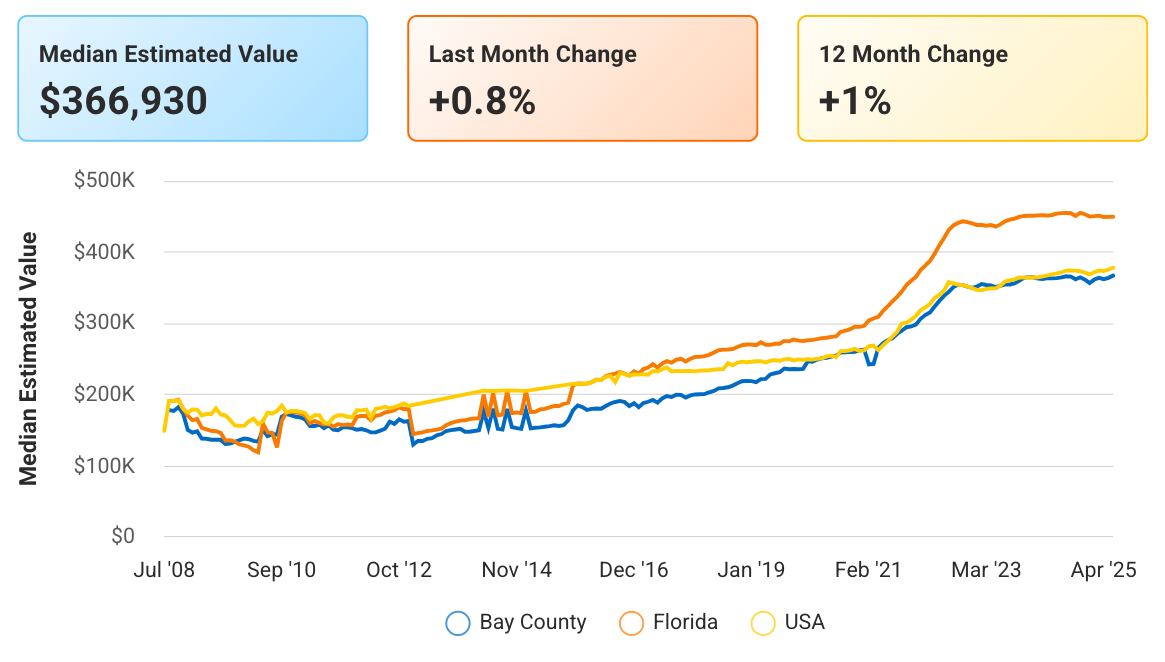

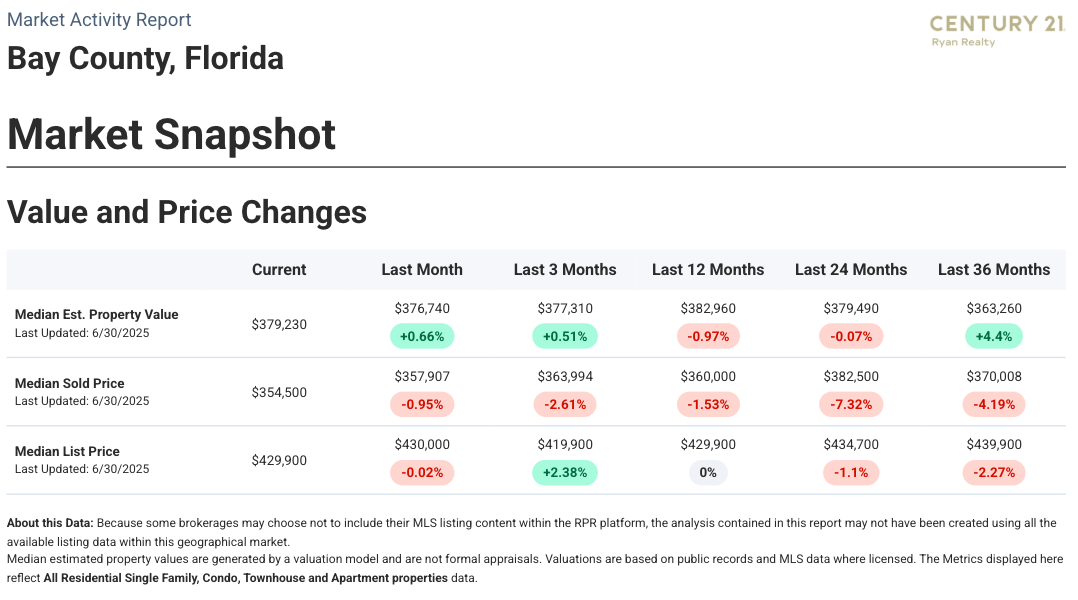

Many homeowners are still pricing their homes based on the hot market of 2021–2022. But with higher interest rates, more homes on the market, and buyers being much more cautious, overpriced listings are sitting longer and ultimately being pulled. Rather than drop the price, many sellers are choosing to “wait it out.”

💰 And they can wait. Thanks to massive equity gains over the past few years, homeowners have breathing room and aren’t feeling pressured to sell. Many sellers remain firm on high asking prices, even as the current market shows signs of cooling.

What Sellers Are Hoping For: Lower Interest Rates

Many sellers are banking on interest rates dropping, believing it will trigger a rush of new buyers—and they’re not wrong. History has already backed that belief.

🏡 Earlier this year, D.R. Horton, one of the largest national homebuilders, offered mortgage buy-downs that dropped rates into the high 3% range. The result? A surge of buyers. Their communities saw renewed interest almost overnight, and in some areas, demand even outpaced supply.

This real-world example highlights exactly what sellers are waiting for: the moment when rates drop just enough to reignite buyer urgency.

📅 Timeline for Lower Rates:

According to Fannie Mae and the Mortgage Bankers Association, interest rates are expected to fall into the low 6s by the end of 2025, with potential for high 4s or even upper 3s by late 2026. If inflation continues to cool and the Fed begins easing rates, we could start to see meaningful changes as early as Spring 2026.

That’s why many sellers are holding off—they expect a wave of buyer activity as soon as financing becomes more affordable.

What This Means for Buyers: Buy Now, Refinance Later

Here’s the twist: The best time to buy might actually be right now—before that wave of buyers returns.

🏠 Why?

- Cooling Market –

-

Less competition = better negotiation power

-

Healthy inventory = more choices

-

Prices are flatter in many markets

-

Sellers are more flexible now than they will be later

If you buy now at a higher rate, you can refinance later when rates fall—without having to compete in bidding wars.

Once rates drop into the 5s, experts expect the market to heat up again fast, with price appreciation and bidding wars returning in full swing.

Bottom Line

If you’re a buyer, don’t wait for rates to fall—everyone else is waiting too. When that moment comes, you’ll be competing with the masses. Buying now gives you more leverage, more options, and the potential to refinance into a better rate later.

If you’re a seller, be realistic about today’s market. Price competitively and understand that today’s buyers are sharp, strategic, and value-driven.

Whether you’re buying or selling, the key is to work with a professional who understands your local market—and how to help you navigate it successfully.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link