Ready to Go – Build your Dream Home in Magnolia Bluff, your next Coastal Cottage Retreat!

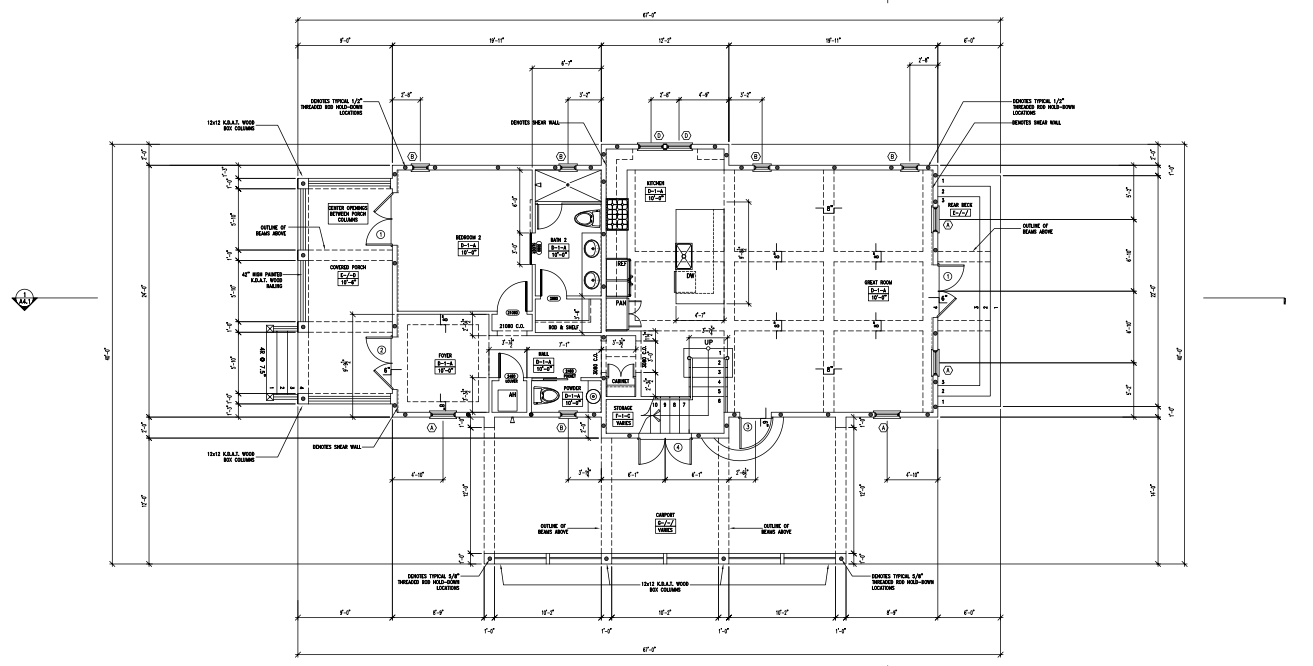

4 Bed | 1 Bunk Room | 5 Bath | Heated & Cooled 2,493 Sq Ft | Porch & Carport 1,024 Sq Ft | Designed for Comfort, Convenience and Functionality!

A Buyer’s Guide to Coastal Living in the heart of Gulf County, Florida!

Welcome to Magnolia Bluff, a hidden gem along 👉 Florida’s Forgotten Coast. Tucked between Mexico Beach and Port St. Joe, this peaceful community offers a relaxed coastal lifestyle just steps from the Gulf. Whether you’re planning your forever home, a second getaway, or a smart long-term investment, Magnolia Bluff is the perfect blend of opportunity and ease.

This ready-to-build ¼-acre homesite presents a unique advantage: a pre-existing slab foundation, architectural plans, and survey data—meaning you can skip the delays and jump straight into your build. Located just 0.4 miles from public beach access, you’ll enjoy the convenience of a golf cart-friendly neighborhood close to local shops, dining, and boat ramps.

For those seeking a simplified path to construction, the seller is offering an optional pre-construction package in collaboration with a licensed builder and lender. Choose a turnkey build or manage the process independently—either way, the groundwork is already in place.

Located in a federally designated Opportunity Zone, the lot comes with potential tax benefits, increasing its appeal to investors.

Magnolia Bluff is more than a location—it’s a lifestyle. Spend your days scalloping in the bay, paddle-boarding in the calm Gulf waters, or relaxing on dog-friendly beaches. You’ll also be minutes from vibrant coastal communities like Mexico Beach, Port St. Joe, Cape San Blas, and St. George Island, all known for charming shops, local seafood, and a strong sense of community.

This is your chance to build in one of Gulf County’s most accessible and desirable neighborhoods.

RVs and 5th wheels may be stored on the property when housed in a garage, per HOA guidelines.

🌴 HOA and Land Information

👉🔹National Flood Hazard Layer FIRMette – Magnolia Bluff

👉🔹Survey – 123 White Blossom Trail

👉🔹1 Magnolia Bluff HOA Articles of Incorporation-1

👉🔹2 Magnolia Bluff HOA BY-LAWS

👉🔹3 Magnolia Bluff HOA CC&Rs 05052015

👉🔹4 07-31-2020 CC&R Amendments filed w Gulf County

- The lot is prepped & ready to build w/slab in place.

- Plumbing paid = $90K

- water fees paid =$8K

- engineered plans by SEC =$12K

- HOA $175/YR.

- X Flood Zone.

- No flood insurance is required.

🌴 Why Mexico Beach to Port St. Joe is a Great Place to LIVE

✅ Small-Town Coastal Charm

– Mexico Beach and Port St. Joe maintain their laid-back, Old Florida feel, far from the hustle of overdeveloped beach towns.

✅ Affordable Coastal Living

– Compared to other Florida beach destinations, home prices, insurance, and cost of living are still reasonable—especially for full-time residents and families.

✅ Safe & Welcoming Communities

– Low crime rates and friendly neighbors make it ideal for raising a family, retiring, or relocating.

✅ Beautiful Neighborhoods

– Options range from beachfront condos and cottages to newer subdivisions like WindMark Beach and Magnolia Bluff.

✅ Walkable & Golf Cart-Friendly Towns

– Whether you’re heading to dinner, the beach, or a local event, many areas are designed for relaxed, easy access.

💼 Why Mexico Beach to Port St. Joe is a Great Place to WORK

✅ Supportive Local Economy

– Active Chambers of Commerce in both Mexico Beach & Port St. Joe provide networking, business development, and relocation support.

✅ Entrepreneurial-Friendly Climate

– Local governments and organizations encourage small business startups and offer resources, including Opportunity Zone tax advantages.

✅ Remote Work Ready

– Fiber-optic internet is available in many communities, making it easy for remote professionals and digital nomads.

✅ Growth Potential

– As the area continues to recover and expand post-Hurricane Michael, there are strong long-term opportunities in real estate, construction, tourism, and hospitality.

🎣 Why Mexico Beach to Port St. Joe is a Great Place to PLAY

✅ Uncrowded, White-Sand Beaches

– Enjoy peaceful, dog-friendly beaches without the massive crowds found in larger destinations.

✅ Water Adventures Everywhere

– Kayaking, paddleboarding, fishing, snorkeling, and scalloping in St. Joseph Bay or the Gulf of Mexico.

✅ Local Marinas & Boat Ramps

– With easy access points like Port St. Joe Marina, Frank Pate Park, and Captains Cove Marina, you’re never far from open water.

✅ Parks, Trails & Outdoor Recreation

– Scenic trails, boardwalks, dog parks, and eco-preserves offer ample space to explore nature and stay active.

✅ Vibrant Events & Arts Scene

– Monthly farmers markets, local festivals, and art walks bring the community together year-round.

✅ Cultural & Historical Richness

– Enjoy museums, lighthouses, and local landmarks like Constitution Convention Museum State Park.

✅ Friendly, Walkable Town Centers

– Reid Avenue in Port St. Joe and downtown Mexico Beach offer shopping, live music, locally owned cafes, and fresh seafood markets.

⭐ BONUS: Local Resources That Make Life Easy

-

👉 Gulf County Welcome Center & 👉 Mexico Beach Welcome Center help new residents and visitors acclimate quickly

-

👉 Gulf County & 👉 Bay County Chambers of Commerce offer relocation guides, business contacts, and networking

-

Local Schools – Elementary to Adult

👉 Port St. Joe Elementary School

👉 Port St. Joe Jr./Sr. High School

👉 Gulf County Adult School

👉 Gulf County School Board

👉 Gulf/Franklin College Campus

-

Pet-friendly beaches, trails, and community spaces welcome your furry friends

Nearby Boat Landings

Healthcare & Wellness

(Pharmacies, Doctors, Dermatology, Hospitals, Vets, Spa & Salons)

- Pharmacy

CVS

Buy Rite Drugs - Dermatologist

Website - Ascension Sacred Heart Gulf – Full-service hospital

Website - Doctor Offices

Pan Care FL

Ascension Rachel Bixler

Ascension David Newton

Ascension Nancy Anderson - Veterinarian

PSJ Animal Hospital

Parkway Animal Hospital - Garden Club – Reid Street

Facebook - Lux Salon – Personal care and beauty

Facebook - Salt Air Beauty & Hair Care – Personal care and beauty

Google | Website | Facebook - Fit & Fitter – Fitness and lifestyle gear

Facebook - Wave Aesthetics – Full-service spa and skincare

Facebook - Cut’n Up Family Haircare

Website - Nails By Liz

Facebook

Dining & Local Eats

(Restaurants, Cafés, Bars, Ice Cream Shops, Pizza, Seafood)

- Look Out Lounge

Website - Brick Wall

Website - Uptown Raw Bar

Website - Provisions – Eclectic bistro with indoor/outdoor dining

Website - Peachy’s Beach Eats – Casual, coastal favorites

Facebook - Krazyfish Grille – Seafood, music, and open-air fun

Facebook - Joe Mama’s Wood Fired Pizza – Craft pizza and wine

Website | Facebook - Shipwreck Raw Bar

- Haughty Heron

Website - Pomodoro Italian

Website - Long Bills on the Cape

Website - Hunt’s Oyster Bar on St Joe Bay

Google - Sparks BBQ

Website - The White Marlin

Website - Scallop Cove – The Cape

Website - Sisters’ Bistro

Website - PSJ Grill

Facebook - Peppers Mexican Cantina

Website - The Italian Kitchen

Website - The Great Wall

Website - The Keepers Bistro & Bar

Website - Richey’s Roadhouse Grill

Website - The Joe

Google - Sweet Bunz

Google - Bayside Bakery

Website - St Joe Nutrition

Facebook - Sand Dollar Cafe

Website - The Mill – Bar, lounge, and liquor store

Google | Facebook - Sunrise Cafe – Coastal-inspired breakfast, lunch, and coffee

Google | Facebook - Bruno’s Pizza – Family-style pizzeria with artisan flair

Website | Facebook - Bayside Florist & Gifts – Home décor and arrangements

Facebook - Public Library

Website - Blue Sky – Local nonprofit and community initiatives

Facebook

Resources:

👉 GulfChamber.org

👉 The Forgotten Coast Events & Destinations

👉 Mexico Beach Events

👉 SaltAir Farmers Market

👉 Gulf County Property Appraiser

👉 Franklin County Property Appraiser

👉 Outdoor Recreation & Adventure THINGS TO DO

👉 PanamaCity.org

👉 VisitPanamaCityBeach.com

🌅💼🌊 Live, Work, Play! If you’re dreaming of a peaceful, connected life by the water—with room to grow a business or simply enjoy the outdoors—this slice of the Forgotten Coast is a hidden gem waiting for you.

Why Homeowners Choose Mexico Beach, St. Joe Beach, and Port St. Joe – Simple – Coastal Lifestyle!

Whether you’re a remote worker, retiree, or family looking for a fresh start on the Gulf, the Forgotten Coast delivers lasting value, natural beauty, and the kind of coastal charm you’ll never want to leave.

👉 Search Land In The Area Here

👉 Century 21 Ryan Realty, Danielle Kemp 📞 850‑896‑2487

👉 Maxwell-Daleiden – Mortgage Loan Originator – Specializing In New Construction

Equal Housing Opportunity. All information deemed reliable but not guaranteed, and subject to change. Buyer to verify HOA Information, zoning, building, and permitting requirements with local authorities.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link