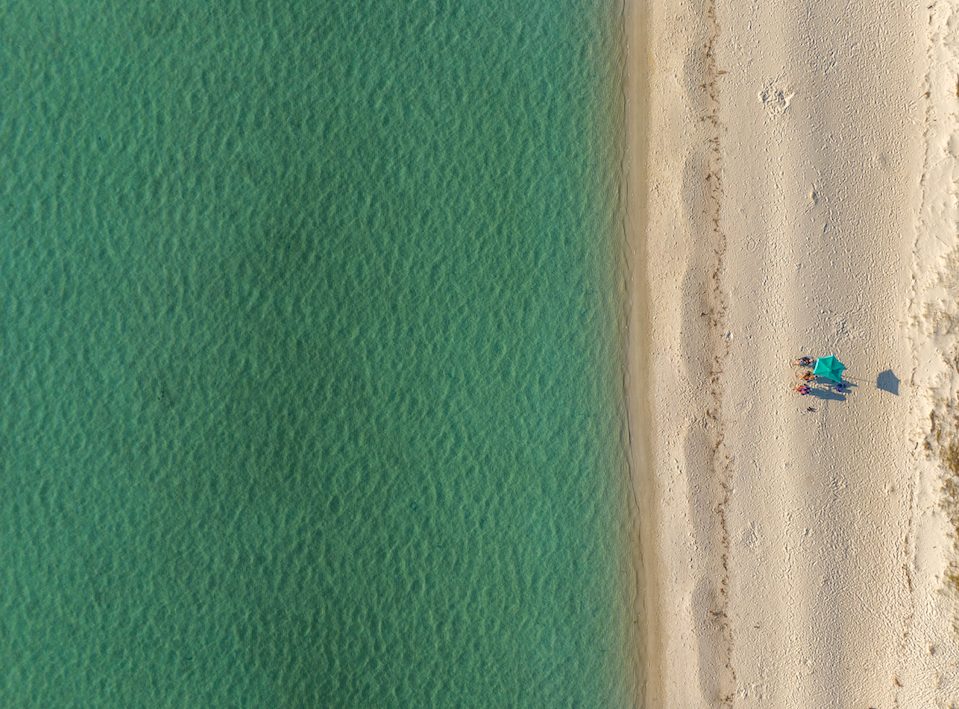

TWO Gulf-Front Investments For Sale | Sold Separately | Each 330 sq ft Studios in PCB, Florida!

🌴 Looking for the perfect investment in Panama City Beach? Here is your opportunity to own a historic, turnkey condo, or two directly on the sand! With unobstructed views of the emerald coastline, short-term rental approval, and all utilities included, this affordable beachfront studio is the ideal choice for both personal enjoyment and strong rental income. As a Gulf front investment in a thriving vacation market, both units have the potential to deliver both lifestyle and long-term equity benefits.

🛏 2 Turnkey Studios — Fully Furnished & Rental-Ready

All utilities in the HOA — power, fiber-optic Wi-Fi, water, security, and trash. Whether you’re launching an income-producing STR or seeking your personal escape, 301 and 310 (sold separately) are ready for you. 🛋️ These Gulf front investments offer an unbeatable combination of location, charm, and long-term growth potential. 2 Fantastic options – both priced under 200k, considered value per their specific location within the building and tasteful interior design.

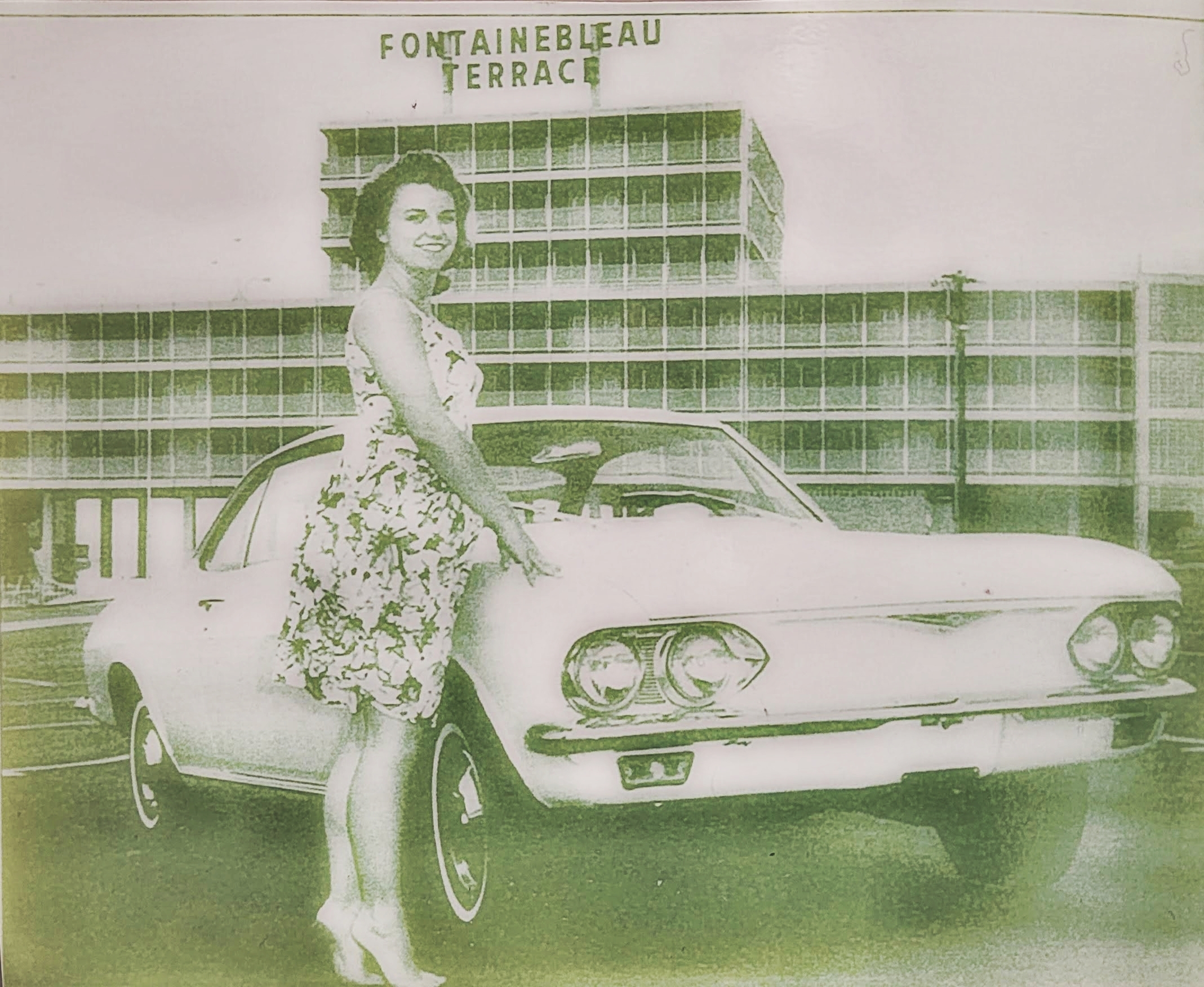

🏖 Amenities & Historic Charm

Fontainebleau Terrace is one of PCB’s most iconic co-ops. Owners and guests enjoy:

-

Private Beach Access

-

Beachfront Pool

-

2 on-site laundry rooms (2nd & 3rd floor)

-

Outdoor Pavilions

-

Upcoming upgrades: 5th Floor Owners Lounge, Gym, Rooftop Deck

The property has passed its milestone inspection, offering peace of mind and positioning the community for continued growth, enhancements, and value as the board nurtures the future of the building. It’s Rental-Ready & Affordable Gulf Front Real Estate!

📍 Vibrant Location = Strong Return Potential

Located just over a mile from major attractions, including Pier Park, TopGolf, and the Pirate’s Dinner Theater, this area offers high foot traffic and consistent tourism flow. With PCB’s year-round events and booming rental market, this unit can offer strong ROI now — and into the future. Income projections available upon request. 📈

-

📘 👉 FBT Rules and Regulations

-

📘 👉 FBT Rules

-

📊 👉 FBT Condo-Projection offered by

-

📘 👉 BookPCB Rental Management Company

-

📘 👉 Unit 310 Signature Destinations

-

📘 👉 Unit 301 Signature Destinations

🔒 Ownership Confidence + Documentation: Ask me, or your favorite agent to provide the following. ✅ This is a Co-Op and all key documents are available per request:

- 🗂️ Assessment Schedule

-

🧾 Lead Base Paint Disc

-

🌊 Flood Disclosure

-

🏠 Seller Disclosure

-

🛠️ R&R Revised 2024

-

🏢 Milestone Inspection

-

💰 Revised Budget 2025

-

📈 SIRS – Reserve Study

-

📝 Articles of Incorporation

-

⚖️ By-Laws

📍 Fontainebleau Terrace Property Highlight 301 Pictured Below

👉 14401 Front Beach Rd Unit 301, Panama City Beach, FL 32413

💰 Studio in PCB Offered at $139,900

EXCEPTIONAL GULF-FRONT INVESTMENT OPPORTUNITY AT THE HISTORIC FONTAINEBLEAU TERRACE. Secure one of the most accessible Gulf-front assets in Panama City Beach! Unit 301 is perfectly positioned on price, offering a rare entry-level opportunity for an investor ready to capture the full potential of this high-demand market. Tastefully updated and situated to maximize scenery, this unit is a blank canvas for your rental success, and one of the lowest priced condo’s in PCB, Florida!

📍 Fontainebleau Terrace Property Highlight 310 Pictured Below

👉 14401 Front Beach Rd Unit 310, Panama City Beach, FL 32413

💰 Studio in PCB Offered at $185,900

EXCEPTIONAL GULF-FRONT INVESTMENT OPPORTUNITY AT THE HISTORIC FONTAINEBLEAU TERRACE. Cash in on this rental asset! Tastefully designed and perfectly positioned within the building’s layout to maximize both scenery and return, Unit 310 is a rare find that is truly ready to perform. PREMIUM WEST END LOCATION: Experience the most desirable side of Panama City Beach. Located on the quieter West End, you are perfectly situated to enjoy the best of the Gulf lifestyle while being just over a mile from the heart of the action. Whether it is a quick trip to the luxury shopping and dining at Pier Park, the new Topgolf, or the renowned Pirate’s Dinner Theater, everything is within reach.

Historic Fontainebleau Terrace: 14401 Front Beach Road, Panama City Beach, FL 32413

⚠️ Disclaimer

All information is deemed reliable but not guaranteed. Buyer to verify HOA restrictions, zoning, licensing, and permitting with the proper authorities before purchase. This blog is for informational purposes only and not legal or financial advice.

Century 21 Ryan Realty

Danielle Kemp Licensed REALTOR®

Luxury Marketing Specialist

Direct: 850-896-2487

Meet me here, Your Panama City Beach Investment Expert! Dani Kemp

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link